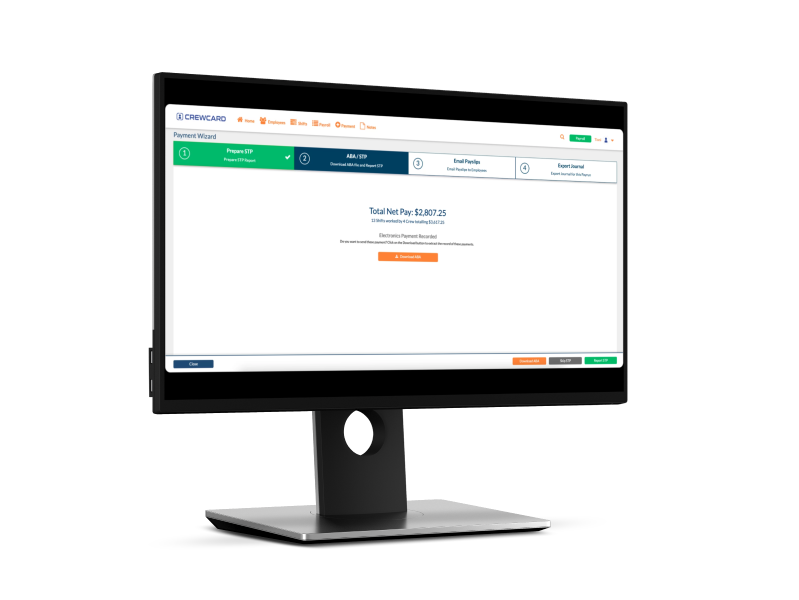

In this step, CrewPayer ensures a seamless experience for payroll administrators. After verifying payroll details, admins can easily download the ABA (Australian Banking Association) file, which can be uploaded directly to the bank. If any errors are detected in the ABA file, administrators can easily return to the previous step for corrections. Once the ABA file is error-free, administrators can proceed to report the STP with their consent as a user, ensuring a smooth and compliant payroll process.

CrewPayer offers flexibility for payroll administrators. If you prefer to use another payroll software for specific accounting or reporting needs, no problem. With CrewPayer, you can easily export your payroll journal for perfect integration with other software, ensuring consistent financial reporting and accounting practices across your organisation.